Pakistan’s Exports to Afghanistan Gain Momentum Amid Trade Growth

ISLAMABAD:

Pakistan’s export strategy is bearing fruit. Pakistan’s Exports to Afghanistan jumped an impressive 38.68% in the fiscal year 2024-25, reaching $773.892 million—up from $558.032 million in FY 2023-24, according to State Bank of Pakistan (SBP) data.

This export surge marks a key success in Pakistan’s trade diversification efforts and regional market expansion.

Quarterly & Monthly Export Trends

Pakistan’s exports to Afghanistan also showed increases during key months. In June 2025, exports reached $50.230 million, up 8.24% year-on-year from $46.405 million in June 2024.

However, month-on-month exports dipped by 11.63% in June 2025, compared to $56.843 million in May 2025—a fluctuation analysts attribute to seasonal shifts and logistical constraints.

Export Expansion Signals Strong Trade Strategy

This dramatic rise—over one-third year-on-year—in Pakistan’s Exports to Afghanistan demonstrates the effectiveness of targeted trade policies, improved border management, and growing demand for Pakistani products in Afghan markets.

Moreover, broader regional data shows exports to nine neighbouring countries rose by 1.49%, even as total exports grew 4.24%—further highlighting strong performance in Afghanistan specifically.

Key Export Commodities & Market Opportunities

Trade experts note that exports such as sugar, cement, pharmaceuticals, textiles, rice, fruits, and vegetables have driven growth. Notably, over 700,000 tonnes of sugar were exported to Afghanistan during FY 2024-25.

This diversification aligns with Pakistan’s broader agenda to strengthen regional supply chains and meet neighboring demand through competitive pricing and quality.

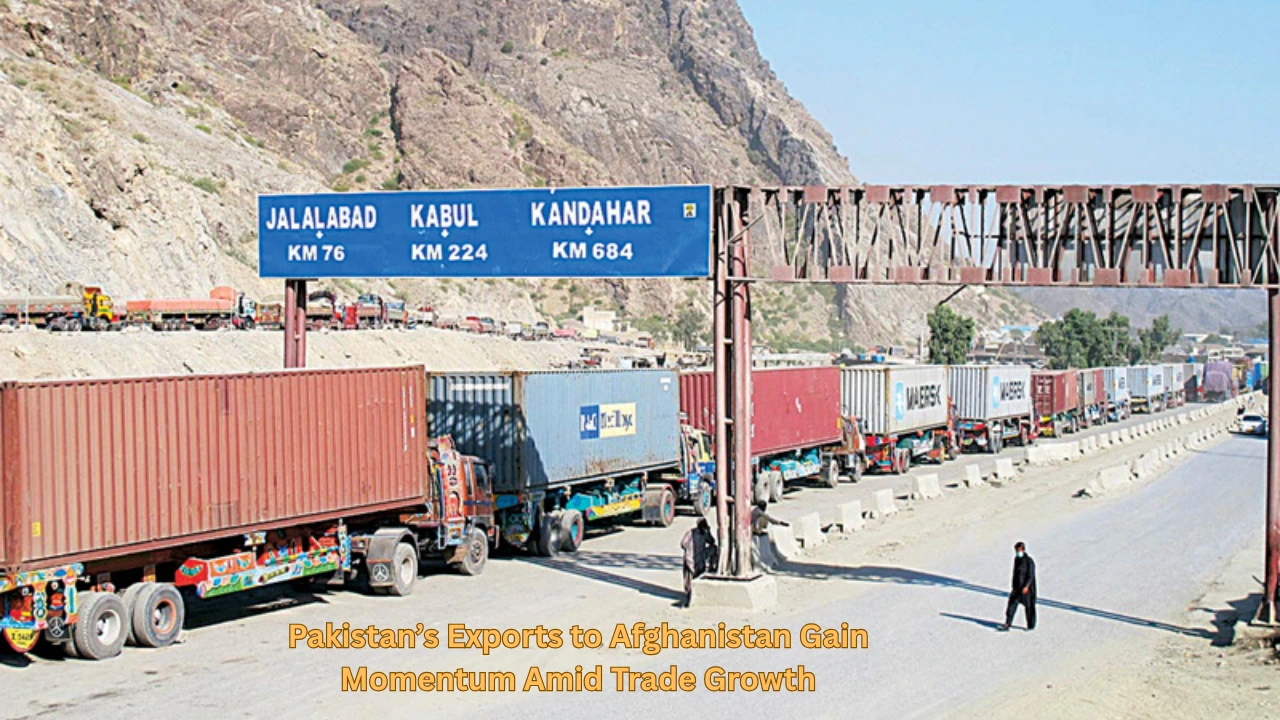

Trade Infrastructure Boosting Exports

Robust transit routes such as Torkham, Chaman, and others remain pivotal. The Khyber Pass Economic Corridor (KPEC), aimed at improving connectivity with Afghanistan and Central Asia, is expected to drive export efficiency and lower transit costs.

These infrastructure upgrades may bolster future export competitiveness and logistical resilience.

Challenges Remain Despite Gains

While export figures are impressive, broader trade data reveals Pakistan’s regional trade deficit widened by 29–36% in FY 2024-25 due to rising imports—especially from China and India.

Balancing export gains with import controls will be key to achieving long-term trade stability and reducing the overall trade gap.

Strategic Implications for Bilateral Relations

These export gains improve Pakistan-Afghanistan economic relations and reinforce Pakistan’s role as a reliable trade partner. Improved water, power, and supply linkages may deepen cross-border economic integration.

Looking ahead, projects like the Uzbekistan–Afghanistan–Pakistan Railway and transit agreements under the Lapis Lazuli Corridor could further expand trade potential and reduce logistical bottlenecks.

Summary Table

| Metric | FY 2023–24 | FY 2024–25 | Change (%) |

|---|---|---|---|

| Total Exports to Afghanistan | $558.03 million | $773.89 million | +38.68% |

| June Exports (Year-on-Year) | $46.41 million | $50.23 million | +8.24% |

| June vs May (Month-on-Month) | $56.84 million | $50.23 million | –11.63% |

Conclusion: Momentum Builds for Pakistan’s Exports to Afghanistan

Pakistan’s Exports to Afghanistan have shown remarkable growth in FY 2024-25, signaling robust market demand, successful trade facilitation, and strategic economic focus. Despite regional headwinds and higher import pressures, this export boom positions Pakistan to strengthen bilateral ties and bolster its regional trade footprint. Pakistan-Afghanistan Export Growth (FY 2024-25)

The outlook looks promising. If supported with continued infrastructure enhancements, policy coordination, and trade diversification, this momentum could enable Pakistan to sustain exports to Afghanistan and solidify its position as a key export supplier in South Asia. Click here for more about US Imposes 19% Duty on Pakistan Imports.