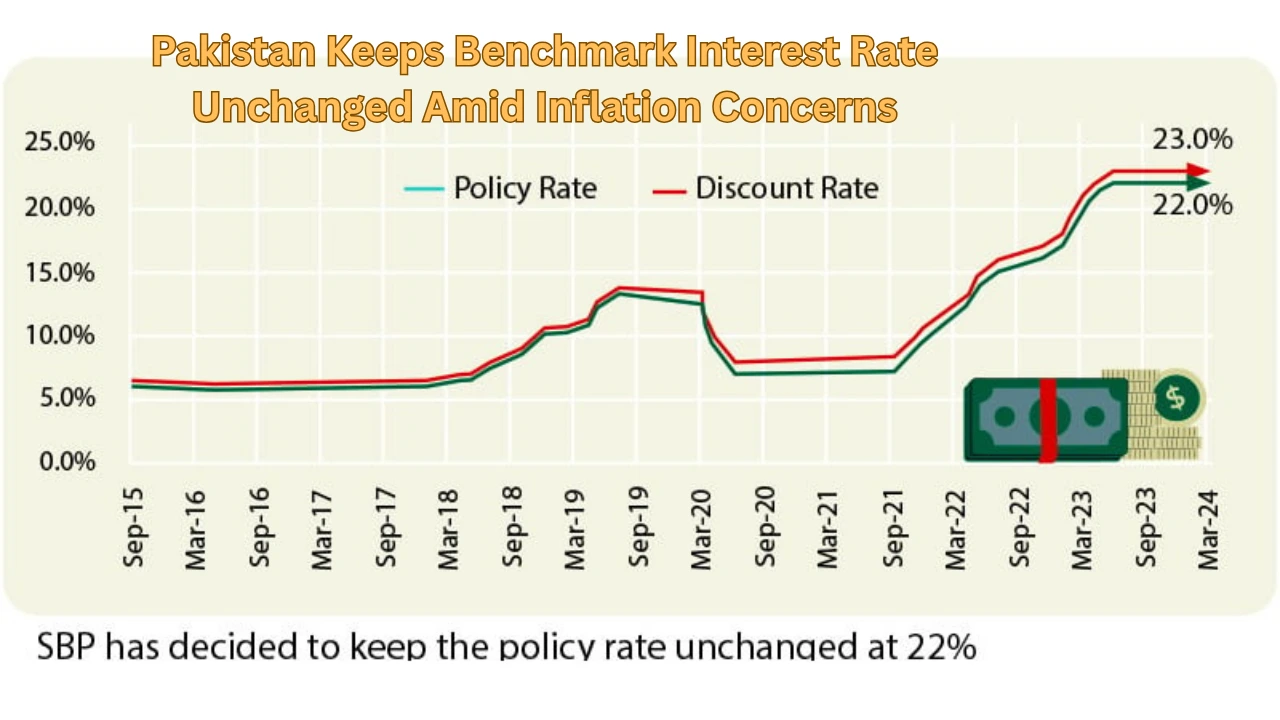

KARACHI: The State Bank of Pakistan (SBP) has kept the benchmark interest rate unchanged at 22%. The announcement came during its latest monetary policy meeting on Wednesday.

This decision was cautious but expected. It comes amid high inflation, global economic uncertainty, and ongoing talks with the International Monetary Fund (IMF).

The Monetary Policy Committee (MPC) emphasized the need for a tight policy stance. This is to ensure inflation keeps falling toward the 5–7% medium-term target.

The interest rate has remained steady since June 2023. It is one of the highest in the region. This reflects Pakistan’s efforts to stabilize its macroeconomic indicators.

Inflation Trends and the Role of Interest Rate in Economic Stability

The decision to maintain the interest rate is largely influenced by the ongoing inflation trend. While headline inflation has shown signs of easing—falling to 12.6% in June 2025 from a high of 28.3% a year earlier—it remains elevated compared to SBP’s target range.

According to SBP Governor Jameel Ahmad, the central bank is closely monitoring core inflation, food prices, and utility costs, which continue to fluctuate due to global supply chain disruptions and local energy adjustments.

“We are committed to achieving price stability. A premature reduction in the policy rate could reverse the gains made so far,” the governor stated during the press briefing.

Rupee Stability and Foreign Reserves Support Tight Policy

Another key reason behind holding the interest rate is to preserve the gains made in the foreign exchange market. The Pakistani Rupee (PKR) has shown relative stability against the US dollar, helped by strong remittance inflows, improved exports, and sustained foreign direct investment (FDI) interest in key sectors.

Pakistan’s foreign exchange reserves have also improved significantly, standing at $14.5 billion in July 2025, up from $9.4 billion a year ago. This recovery has provided breathing room for the government but has not completely eliminated the risks posed by external shocks, oil price volatility, and debt repayments.

Global Economic Trends and IMF Engagement

The SBP’s decision is also aligned with global interest rate trends, where several central banks—including the Federal Reserve and European Central Bank—have chosen to maintain or cautiously reduce rates due to inflation fears.

In Pakistan’s case, the central bank must balance tight monetary policy with the conditions set by the IMF Extended Fund Facility (EFF). A premature interest rate cut could raise red flags with international lenders and weaken market confidence.

Ongoing talks with the IMF for a new bailout program, along with recent credit rating upgrades by global agencies, underscore the importance of keeping inflation under control and ensuring fiscal discipline.

Impact on Businesses and Borrowers

While the stable interest rate supports long-term economic stabilization, it also places a burden on the private sector, especially small and medium enterprises (SMEs) and borrowers facing high borrowing costs.

Industries such as manufacturing, real estate, and retail continue to struggle with high financing costs, which limit their capacity to expand, invest, or hire. Business leaders have urged the SBP to begin easing the policy stance to revive domestic growth.

However, analysts believe that rate cuts may only be considered once inflation remains consistently low for several consecutive months and key macroeconomic indicators stay strong.

Policy Outlook: When Will the Interest Rate Fall?

According to economists, the SBP may begin a gradual interest rate reduction by late Q4 2025 or early 2026, provided the following conditions are met:

- Inflation continues on a downward trend

- Global commodity prices remain stable

- No major fiscal slippages occur

- IMF program negotiations conclude positively

- Current account deficit stays under control

Any hasty cuts to the interest rate could disrupt investor sentiment, increase import pressure, and risk currency depreciation—all of which would undermine the economic recovery Pakistan is currently experiencing. Click here for more info

Conclusion: Patience Over Panic in Policy Direction

By keeping the benchmark interest rate steady, the State Bank of Pakistan has signaled that it values price stability over short-term growth acceleration. While high rates are painful for consumers and businesses, they are necessary to curb inflation, maintain exchange rate stability, and meet IMF reform conditions.

The focus now shifts to how quickly inflation can be brought within the target range and whether fiscal policies will support or hinder that goal. For now, interest rate stability remains Pakistan’s most reliable tool in navigating its complex economic recovery. click here for latest news