Do you always run out of money by the end of the month? Or in an emergency, you feel helpless because you never try to save up some money for such a situation? It may happen to all of us. Whenever we try to stabilize our financial condition, the best way we see is how to save money fast. In this fast-money world, not only are industries developing but the prices of everything are also reaching their peak. In such a situation, a rich person may survive with the amount of money he has in his bank account.

But is it easy for a student who is managing his studies with a part-time job? Or for employees from middle-class families? For such people, the best way to survive in this highly priced government is to save as much as they can. Furthermore, there is a misconception among people that saving is the most difficult task a person can do. This requires that you have to take a maximum amount from your earnings and keep it for saving to make your financial stability strong. Imagine if I told you some amazing and simple tips and tricks through which you can carry out in the process of saving without any hardship.

Saving can be your biggest companion throughout your life even after retirement. So don’t be afraid of doing this. Think of yourself and your family and how you’re gonna support them and yourself in case of any hardship. And not only hardship with saved money, you can get so many things in your future that you want to buy now. All you need is to just be consistent. You don’t have to start from a bigger amount. Take small and steady steps and the sooner you do it the earlier you get the results.

So, get ready as Top Finance Outreach has brought you some of the wonderful tips to on how to save money fast and become financially stable throughout your life.

8 tips for how to save money fast

The following tips are going to change your life completely. So, let’s dig in

Tip # 01: Making a budget plan

Making a tight budget plan is the most crucial step for you in this process. With the help of a budget plan, you will keep yourself on track. And you are also always aware of how much money you’re spending and how much is going to your savings account. Sit on your couch and hold a notepad and pencil. Then start writing down all your expenses like grocery, renting, self-investing means our gym payment, or other appointments. After writing down all this, you will get to know at what point you’re wasting your money. So, after this, make your budget for the next month that will include your money for daily expenses and saving amount.

Tip # 02: Try the 50-30-20 Rule

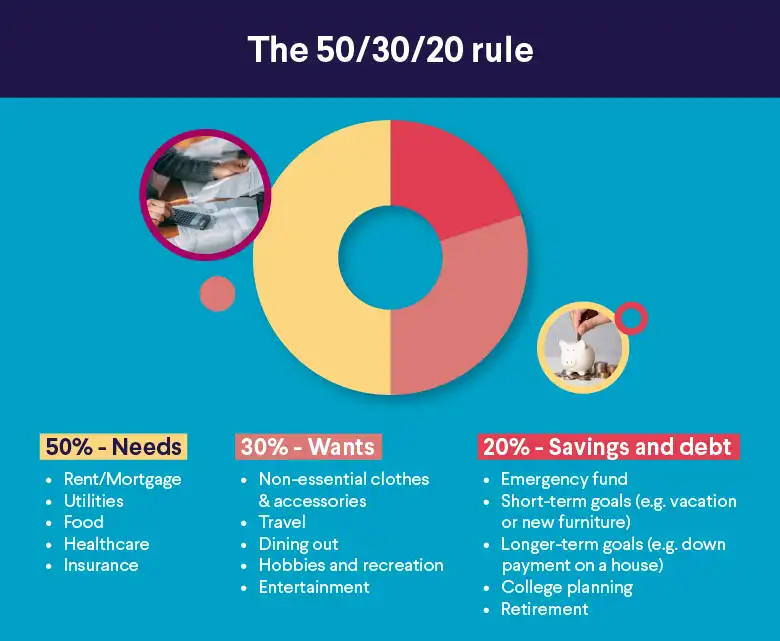

If you are getting confused in making a budget for your month then try the 50-30-20 rule. This rule will help you alone make a budget plan. The 50-30-20 rule will divide your money into three sectors. The first sector consists of excluding 50% of your income from the overall expenses of your month. In the Second sector, you will exclude 30% from the income that you will invest in yourself for example your gym expenses or for your clothes, etc. And the third sector will consist of the remaining 20% percent that will automatically go to your savings account. With the help of this rule, you will easily plan your budget and can save an average amount every month.

Tip # 03: Set saving goals to boost your savings

Saving can be a difficult task if you just add the money to a savings account without having a specific task in mind. And because of this, sometimes you feel fed up with this and will get bored easily. So, to keep continuing this process, set some saving goals in your life. For instance, you set a goal of having a car by using some amount from your savings by the end of two years. This thing will help you keep saving every month because now you have certain things in mind that you want to accomplish.

Tip # 04: Make an automated transfer of money

Automate transferring makes life so easy. You just have to join your current account with your savings account and wallah all set. Everytime you get your salary, the fixed amount for your savings will be deducted from your current account. And after this, the saving amount will directly be sent to your savings account. This thing will stop you from over spending money and safely transfer you income in their respective accounts.

Tip # 05: Try to buy in bulk

Buying things in bulk can also help you in saving some extra amount. Suppose you want to go grocery shopping on the 1st of the month. Then, before going to the market, make a list of all the necessary things that you will use the whole month. Try to minimize your list as much as you can and add only those things that will be in your use for the whole month. After this, buy those things in bulk like rice, Florence, spices, etc. Buying things in bulk can reduce your shopping costs. And eventually leads to extra savings that you will save because of bulk buying.

Tip # 06: Keep track of your spending

Saving can be a tough task for you if you don’t know how much you are spending. Or at what places you spend your money. So, for this situation, try to keep track of your spending. You can either digitally write all the spending in your notebook or you can even manually write that in diaries. Through this method, you will alway be well aware of where you are spending your money.

Tip # 07: Reduce your electricity bills

In the process of how to save money fast, saving electricity can also help you. Buying and keeping your electricity bills down will help you save some extra money making your saving process fast. Switch lights, fans, or PowerPoints off while not in use. Minimize the use of TV and switch to mobile net data from the internet. Use energy-saving bulbs in your house. Secondly, use energy-efficient appliances in your kitchen. These will help you save electricity and reduce your bills.

Tip # 08: Pay off from your debit as soon as possible

Debt can eat your soul out. It’s a time of burden that will take you to the grave until you pay it. So, the first thing after saving an awesome amount is to try to pay all the debt that you have. After this, you will be free from the burden. If you don’t want to use your savings, you can work part-time or can get money from part-time jobs.

Conclusion – How to Save Money Fast

In conclusion, saving money is not a process that will make you feel broken by the end of month. It’s not about completely changing your lifestyle. It’s just about doing little efforts to make yourself financially stable and independent. So, the process of how to save money fast is for you. All the tips and tricks mentioned above are highly effective and easily used. So, don’t be afraid of taking the small step toward your bright future with the promise of financial stability.